Never let a good (self-created) crisis go to waste. –GOP, probably

The ink wasn’t dry on the draconian bills passed by the 86th Legislature before the next Republican-crafted crisis took root; and on the topic responsible for generations of wins for the Grand Ole’ Party–taxes.

In June, residential property owners got a jolt when the Montana Department of Revenue (DOR) nearly doubled property values across the state. Since property values are the basis for the amount of property taxes that owners pay, many residents can expect an upcoming tax increase.

Last year, the DOR warned Montana’s state legislature of the increases and suggested adopting a lowered tax rate to protect homeowners’ budgets–neither the Republican-controlled legislature nor Governor acted.

Instead, the legislature passed temporary and meager property tax rebates, grabbing headlines for “solving” the problem they created. Unlike the automatic income tax rebate, property owners must apply for their rebate. Second homeowners, a group less in need of a tax break, and corporate investment owners can also apply for these rebates.

What shook out from this crisis, so far? What can we anticipate coming down the pike?

Residential owners hung out to dry

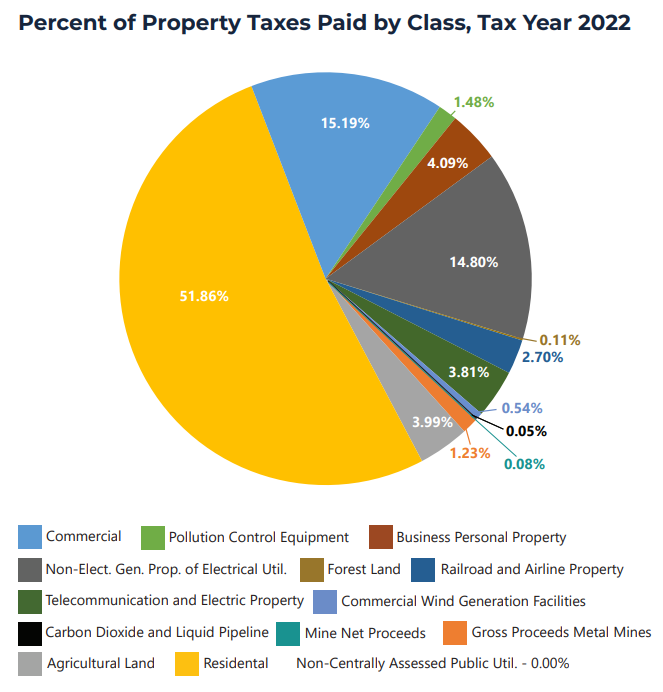

The upcoming hike in state property taxes continues a shift of the tax burden onto residential owners, as state lawmakers passed tax cuts for businesses and utilities for decades. Residential property owners increasingly shouldered the tax burden for schools, local services, state government, and conservation programs. Residential property taxes now comprise almost 52% of all Montana property taxes, up from 30% in 1993.

Local government as a scapegoat

Conservative pundits suggest the property tax crisis is the fault of local governments. Right-wing think tank Frontier Institute argues local (i.e., liberal) governments across Montana are tyrants, who overspend and over govern; therefore, they should lose the authority to build their own budgets and make choices for their communities. Though Frontier’s data are problematic, conservative attempts to restrict government budgets to “inflation + population growth” are growing.

The state legislature already exerts strict control on city and county revenue streams. Yet, conservative politicians are calling for even more economic control over municipalities. Last session, Rep. Jedediah Hinkle (R-Belgrade) introduced a bill to force local governments to adopt the metric. The bill mimicked Colorado’s Taxpayer’s Bill of Rights, which increased revenue uncertainty and stifled local economies, causing most municipalities to leave the accord. Rep. Hinkle’s bill fortunately died in committee.

The “inflation + population growth” metric hinders local governments from investing in services when needed. Limiting local spending requires stark cutbacks during recessions and emergencies, when residents need service the most. Additionally, it prevents long-term planning and limits upfront spending, which infrastructure projects (e.g., schools, roads, and utilities) require.

Calls to control local spending seem to be more about fanning urban v. rural distrust or benefitting corporate interests than fiscal responsibility or tyranny. In Montana, state control of local government threatens democracy. Local governments cannot adopt local sales tax (which could increase fiscal stability and independence), enact affordable housing policy (HB 259, adopted in 2021, overturned existing policies in Bozeman and Whitefish), establish broadband networks, or regulate petroleum fuels, utility lines, or renewable energy infrastructure (adopted this year).

Montana’s regressivity is worsening

Montana’s tax system is not only unstable, it’s regressive. Higher-income households pay a smaller tax share than households with lower incomes: both for property and income taxes. In both 2021 and 2023, state tax cuts exacerbated racial and economic divides throughout the state.

In addition, Montana’s tax policy includes the two most-regressive tax loopholes for the rich: capital gains credits and federal income tax deductions. Capital gains credits alone cost Montana more than $1 billion in revenue, since its passage in 2003. Economic policy shows favoring the wealthy over wage earners stifles economic growth; furthermore, we significantly decrease state revenue with these policies.

A system to subsidize the wealthy and stifle economic opportunity for the rest doesn’t seem very free or equal. These policies are unsustainable and unacceptable, and we now have a tax crisis. How can we tax in a fair way that doesn’t burden working families and seniors on a fixed income?

We have several opportunities. We could lower state tax rates for residential property owners, raise rates on second homes and commercial properties, allow municipalities to adopt local taxes, reassess income tax brackets, close corporate tax loopholes, or reduce capital gains credits.

Our local governments provide essential services–roads, water and sewer, schools, parks, and healthcare–services that protect the common good. We can shape local government, which is a reason to retain local control.

We can also shift the balance of power at the state level. Gallatin County’s newly redistricted 2024 map gives us the opportunity to send five more Democrats to the state legislature. There’s work to be done–we hope you join us.